📉 Case Study 1: How I Slashed Operational Costs by 45%

💰 Smart Cash Negotiations

- Achieved a 45% reduction in costs by shifting from credit to cash-based procurement.

- Negotiated "rock-bottom" prices by eliminating high interest premiums.

📑 The Three-Quote Rule

- Required 03 quotations for every purchase to ensure no overpayment.

- Brought in new vendors to create competition and drive prices down.

🔍 Market Price Checks

- Performed spot-checks to ensure vendors stayed honest with pricing.

- Kept strict oversight on every purchase for total transparency.

🤝 Better Credit Terms

- Where credit was necessary, negotiated prices as close to cash rates as possible.

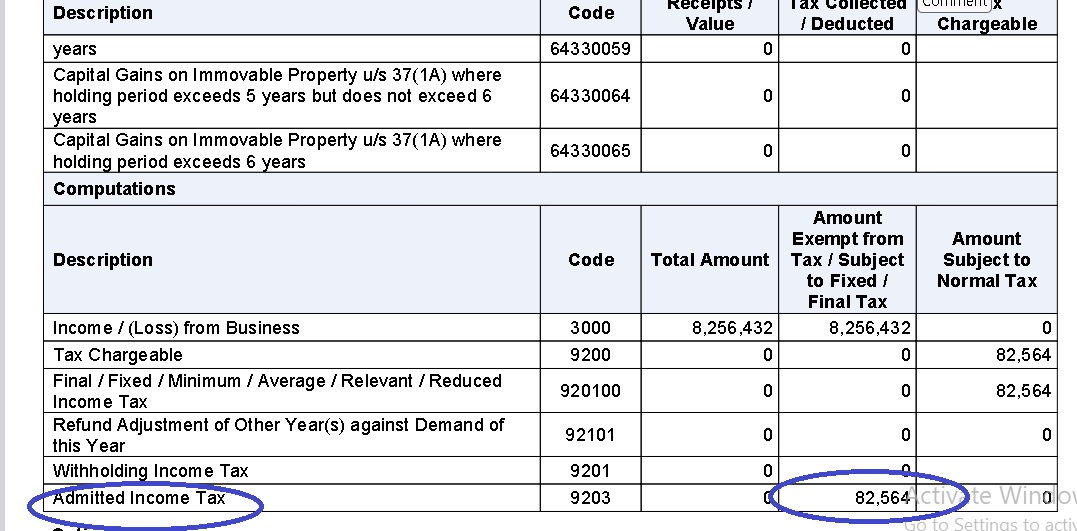

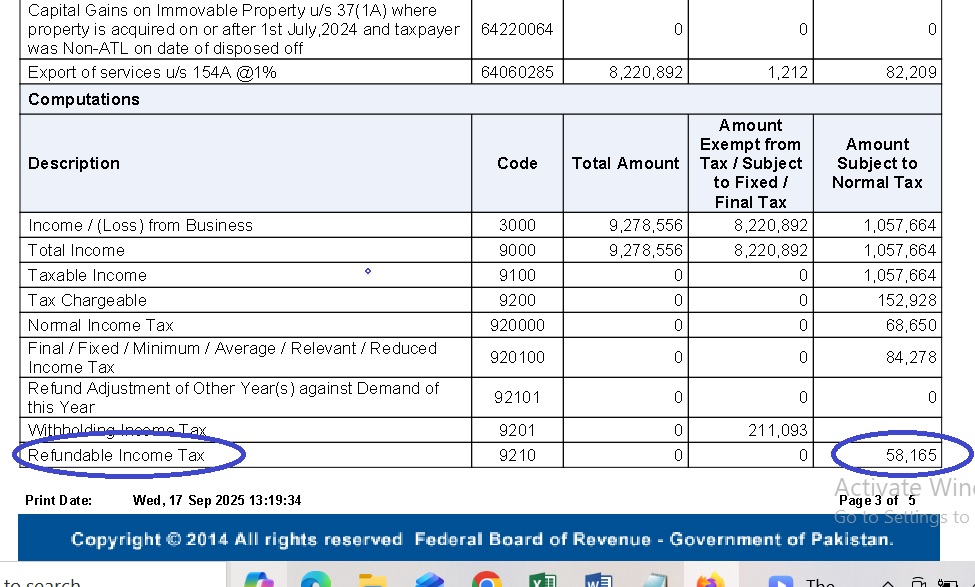

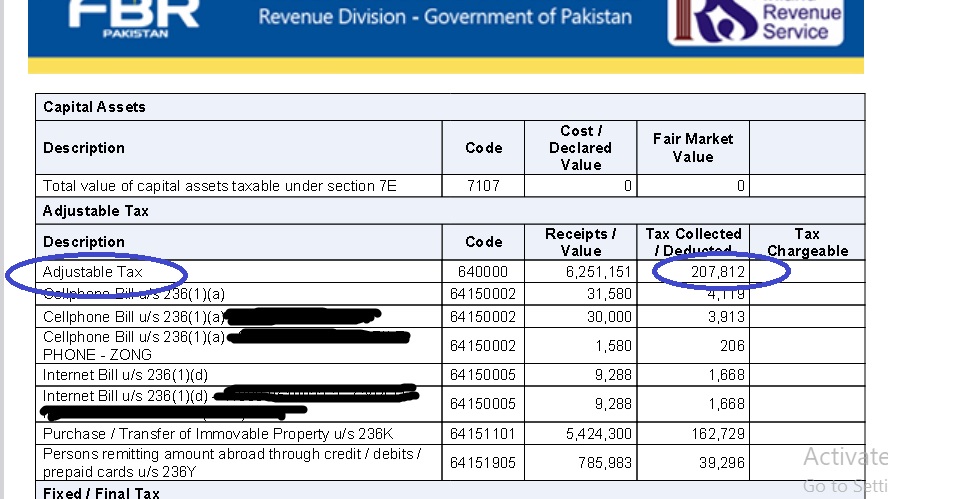

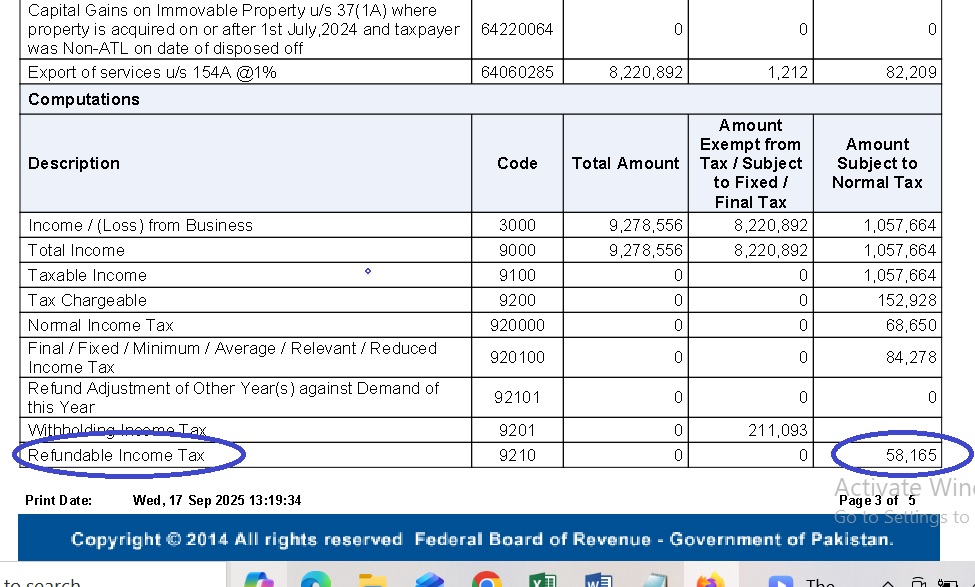

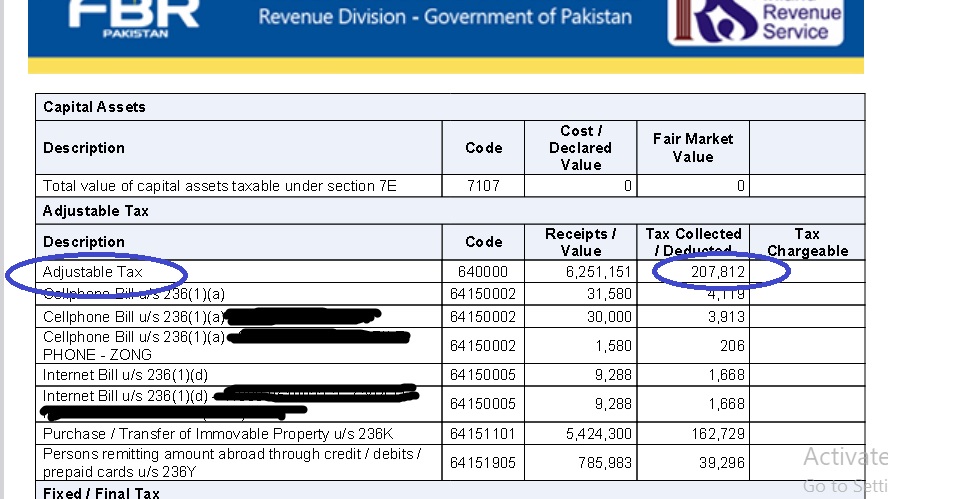

🚀 Case Study 2: Turning a Tax Liability into a Refund

The Challenge: A client was using a tax advisor who failed to claim legitimate Withholding Tax (WHT) adjustments. For years, the client was forced to pay extra tax at year-end because WHT on mobile, internet, and property purchases was ignored.

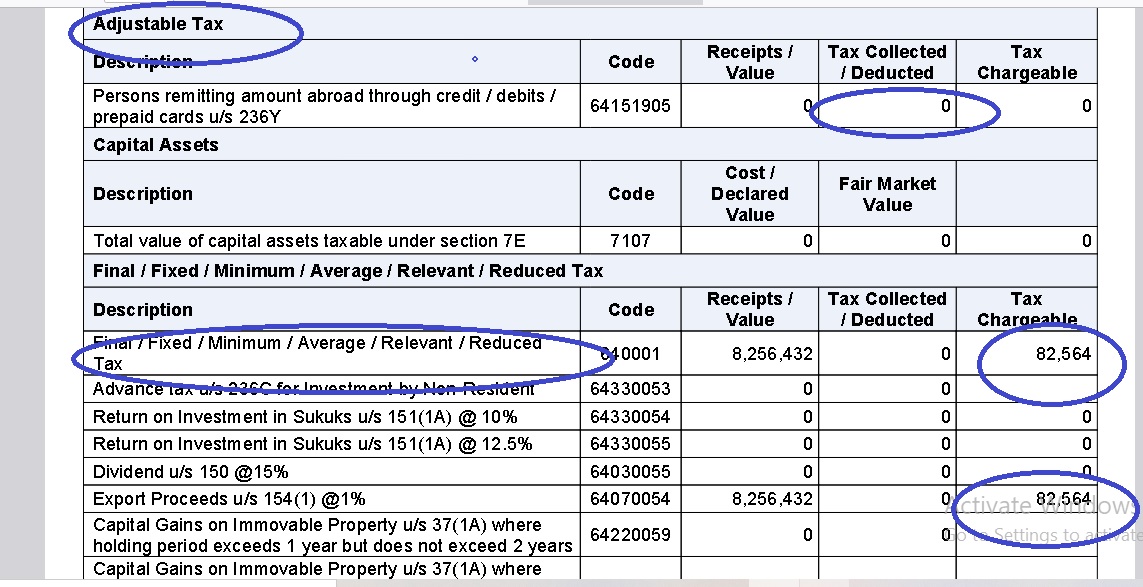

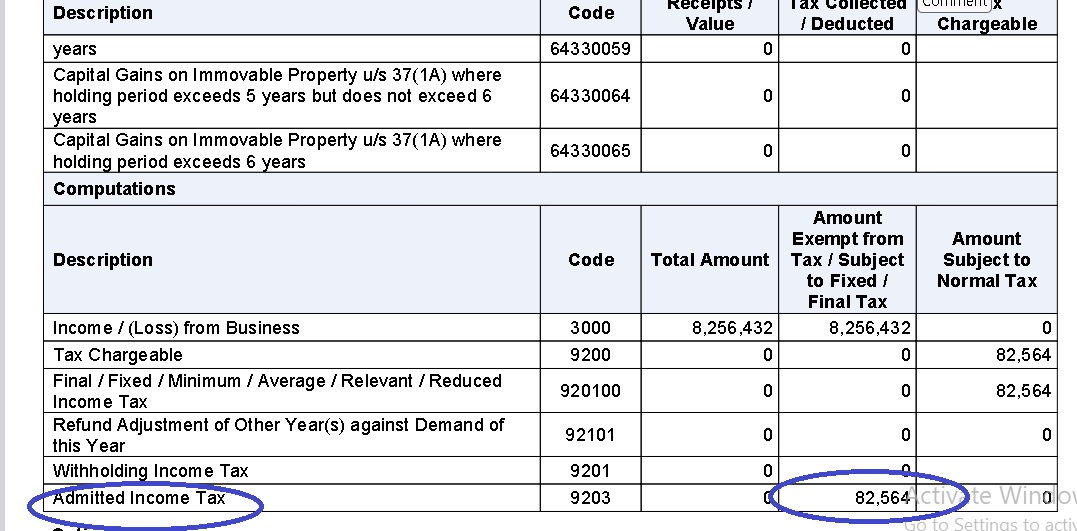

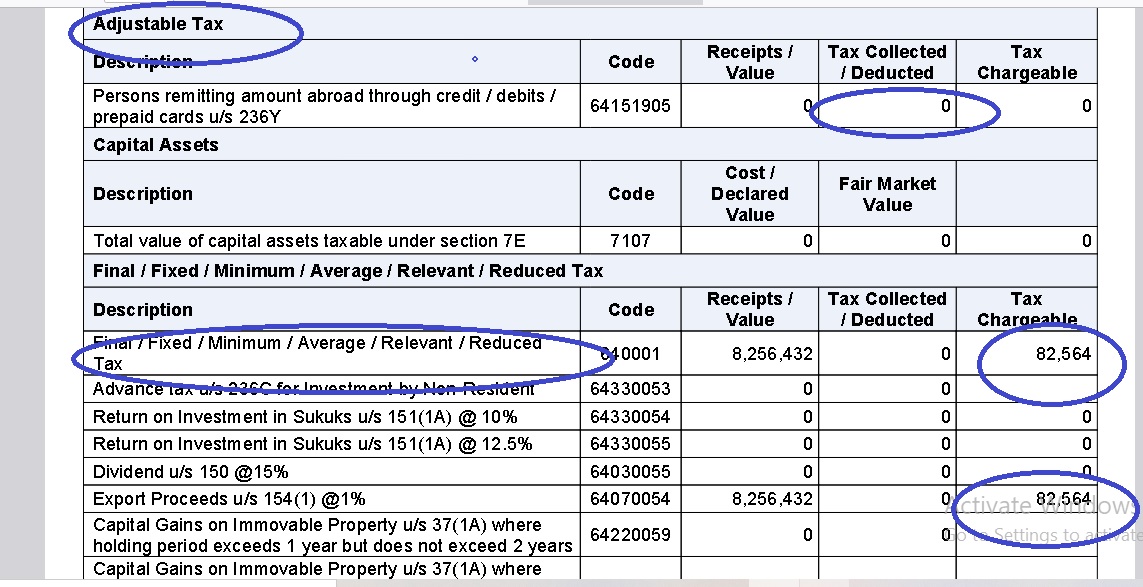

🔍 My Intervention

- Identified missing adjustments for Mobile Phone & Internet bills.

- Captured large WHT credits from Property Transactions.

- Re-aligned the entire return to reflect actual tax paid.

📈 The Result

Successfully converted a Rs. 82,564 Payable into a Rs. 58,165 Refundable status—a total financial benefit of Rs. 140,729 for the client.

Visual Evidence (FBR Tax Evidence):

Before (Incorrect Filing)

Rs. 82,564

Tax Payable to FBR

After (Professional Filing)

Rs. 58,165

Refundable from FBR

Ready to Turn Your Tax Liability into a Refund?

Don't let your hard-earned money stay with the FBR due to oversight and wrong filings. Let’s review your previous filings and optimize your future returns for maximum savings.

Book a Professional Tax Review